When Will Korth first picked up a paintbrush 45 years ago, he had no idea that this paintbrush would one day lead him to owning one of the most successful painting businesses in Westchester: Korth & Shannahan Painting and Carpentry. What started as a summer job painting houses for the Shannahan brothers in Will’s hometown of Chappaqua turned into a more serious opportunity for Will as he quickly moved up in the company. Will honed his painting techniques and quality of work while up on the ladders in these early days. These foundational years of painting taught Will the mantra that he instills within himself and his team to this very day: Hard work pays off.

When Will Korth first picked up a paintbrush 45 years ago, he had no idea that this paintbrush would one day lead him to owning one of the most successful painting businesses in Westchester: Korth & Shannahan Painting and Carpentry. What started as a summer job painting houses for the Shannahan brothers in Will’s hometown of Chappaqua turned into a more serious opportunity for Will as he quickly moved up in the company. Will honed his painting techniques and quality of work while up on the ladders in these early days. These foundational years of painting taught Will the mantra that he instills within himself and his team to this very day: Hard work pays off.

Today, you won’t find Will at the top of a 3-story ladder. He now spends his days estimating new projects and building culture among his all-star team of house painters. Will and his black Labrador, Luna, are known to stop by job sites for safety checks or to make color testing samples for his loyal customers. From its humble beginnings, Korth & Shannahan Painting has made a name for itself as the go-to company for interior and exterior painting, custom carpentry, lead work, and historical restoration here in Westchester County.

After 45 years of leading the residential painting industry in Westchester, Korth & Shannahan knows the key to making a happy customer. “The best painter really listens to what their customer wants. We pay attention to the ‘pain points’ our customers have, like being careful with their pets, protecting the vintage mirror from their great-grandfather, or making sure to cover the new bed of roses in the garden. “What matters to the customer must matter to you” says Korth. For a few lucky customers, Will has been personally taking care of their homes since he was a teenager. 45 years down the line, these customers still call him for their painting and carpentry work. When asked about these long-standing accounts, Korth “believes that its customer service that really drives the bus. There’s no replacement for a happy customer to build your business”.

Will sets the bar extremely high for himself and his team of professional painters and carpenters when it comes to the quality of their work. Each job the Korth team completes is executed to the highest level of workmanship, building trust among their clientele with each coat of paint applied. Unlike the competition, Korth is so confident in his finished product that he provides a 4-year warrantee on every job.

What’s next for Korth? Will and his crew are gearing up for a huge summer of exterior painting. Will’s daughter Olivia, who handles the company’s marketing and recruitment efforts, is hiring new painters to join the team at a steady clip. At the height of the painting season in Spring and Summer, the crew is comprised of over 35 full-time foremen, painters and carpenters who are the core of the company. Olivia is already planning a huge barbeque for the crew, friends, and family in celebration of the company’s official anniversary date in mid-July.

The Korth & Shannahan team expects their 45th year of business to be the best yet. Decades of hard work have certainly paid off for this local, family-owned business. As Will says, “we’ve come a long way…I can’t wait to see where the business takes us next”.

To start your painting or carpentry project, call the Korth Painting office at 914-238-3588, visit our website korthpainting.com, or email olivia@korthpainting.com.

For many of us, estate planning is something we know we should do but often manage to postpone until some indefinite time in the future. But, putting off this part of your financial life could mean passing over an opportunity to preserve the lifestyle you’ve worked so hard to create and to dictate your legacy on your terms.

For many of us, estate planning is something we know we should do but often manage to postpone until some indefinite time in the future. But, putting off this part of your financial life could mean passing over an opportunity to preserve the lifestyle you’ve worked so hard to create and to dictate your legacy on your terms.

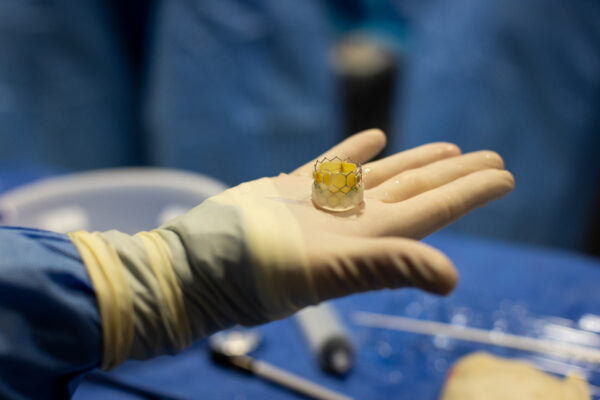

White Plains Hospital is one of just two healthcare facilities in Westchester offering this life-saving procedure to patients in Westchester County. Every patient is fully evaluated by a cardiac surgeon, interventional cardiologist, cardiologist and radiologist to determine the ideal course of treatment, whether that is a TAVR procedure or open-heart surgery. Also, with advanced imaging technology on-site, including high-resolution CT scanning, fusion imaging and cardiac MRI, patients can undergo convenient, same-day pre-operative testing at the Center for Advanced Medicine & Surgery (CAMS) in White Plains prior to the procedure.

White Plains Hospital is one of just two healthcare facilities in Westchester offering this life-saving procedure to patients in Westchester County. Every patient is fully evaluated by a cardiac surgeon, interventional cardiologist, cardiologist and radiologist to determine the ideal course of treatment, whether that is a TAVR procedure or open-heart surgery. Also, with advanced imaging technology on-site, including high-resolution CT scanning, fusion imaging and cardiac MRI, patients can undergo convenient, same-day pre-operative testing at the Center for Advanced Medicine & Surgery (CAMS) in White Plains prior to the procedure.